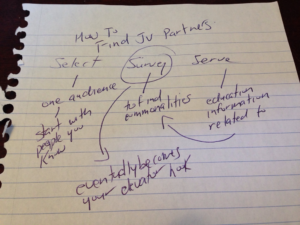

Last night I was talking with another real estate investor about financing using joint venture partners and I ended up scribbling these 3 steps to raise capital for real estate investment:

OK, I know it looks like chicken scratch, but I’ll explain what you’re looking at…

How To Raise Capital For Real Estate Investment

If you’re looking to get private money for real estate, and it’s for a standard rental-type property (like a single family home or a small multi-family), then I believe it’s about these three things:

SELECT

Select ONE AUDIENCE.

This will make more sense when you move onto stage two, but it’s all about speaking to a specific group of people who have specific COMMON problems, want’s and needs.

NOT JUST ANYONE.

Start with people you know.

Eventually, you’ll begin meeting people who share the same thoughts and life patterns.

This is important for the next step which is…

SURVEY

Talk to these people to find more commonalities among them.

And when I say “talk”, I mean REALLY give a shit. You want to connect with who they are…this is NOT just about you ‘selling’ them a real estate investment.

Find their pain points; what frustrates them; listen to the language they use.

This becomes your “elevator pitch”

SERVE

Give them information that provides solutions to the commonalities they’ve described to you.

This doesn’t necessarily mean slamming them with an investment opportunity right out of the gate just because they tell you they hate their other investments.

WHY?

Because all you’re doing is introducing the very SAME thing they’ve identified as a pain point.

Do you see that?

Even if you’re investing in real estate and they’re investing in stocks and bonds, the overall ‘solution’ is still an ‘investment’.

This is why it’s so important to understand your audience DEEPER than the surface level of just “making money”.

It’s probably TOO EARLY to suggest your “opportunity” – and I see investors get this wrong ALL the time.

How I’ve Failed At the “Traditional” Real Estate Investment Pitch

I can’t tell you how many people I’ve stood in front of who are BLEEDING money into the financial market, I’ve TOLD them straight out “hey I can give you 8% right now” and I STILL get a “cool, let me think about it” from them.

I’ll admit that I SUCK at sales…but that’s not the problem.

Because if someone is really wanting to ONLY make X% and I tell them I can do that for them, WHY are they not moving forward?

I’ll bet, if you’re like the hundreds of real estate investors I speak with a month, you’re asking the same question.

The answer is; there’s something else going on.

And that’s why I shifted the way I “pitch to investors”. ( which by the way, is no longer a pitch )

[feature_box style=”8″ only_advanced=”There%20are%20no%20title%20options%20for%20the%20choosen%20style” alignment=”center”]

To learn a modern way to pitch to investors and raise capital for real estate…download my FREE guide: “How to Get Private Money for Real Estate Investing”

[/feature_box]

All I’m sayin’ is that raising capital for real estate investments is about MORE than giving people an investment opportunity sheet.

ANYONE can do that.

The only way you are going to be someone’s choice is when you deliver something of more value to them…something MORE than money.

WHAT DO THEY WANT more than money?

If you can answer that, you’re halfway there.

Have a question or comment? Let’s keep this going – I’ll answer you personally if you comment below.

Cheers!