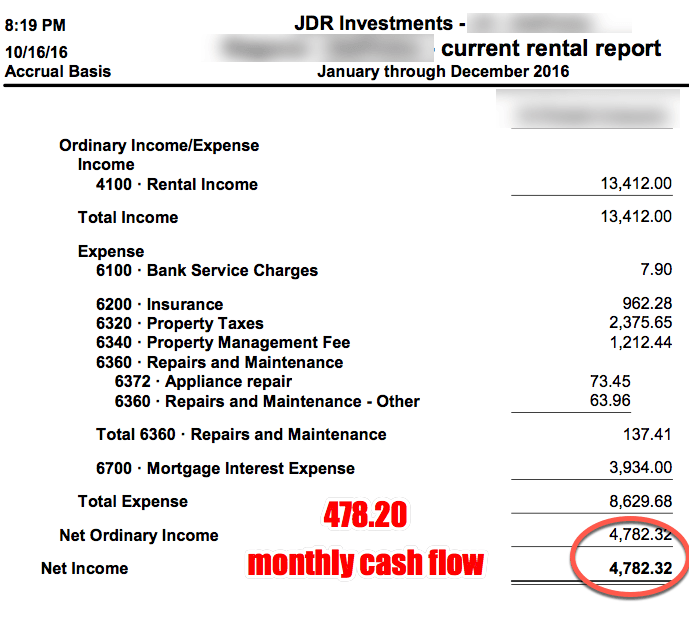

Let’s look at a real life real estate cash flow example.

I just sent off this JV report to my co-venture partner.

GREAT cash flow for a single family home, don’t you think?

(NOTE: this is a 10-month report because I took it in October of this year – just in case you’re double checking the math)

Truth is, it took a few years to stabilize this income.

Repairs, maintenance, etc.

And we’ve prevailed.

Because we’ve sat on the property, letting it build in equity and increasing the rent over time.

Now.

This is just ONE of my properties.

What About The Mortgage Principle?

You’ve probably noticed the mortgage principle is missing.

Even though it’s “profit/income”, it’s not “cash flow” because you can’t spend it every month.

It’s a paper number.

You realize it when you either sell or refi.

In Quickbooks, there is a separate account allocated for the principle.

I’ve just followed Accountant-In-A-Box to set everything up – easy peasy.

So even though your mortgage paydown/principle is part of your overall ROI, you can’t really count it as cash flow IMO.

So let’s talk about…

How Much Real Estate Cash Flow You Need

I know this real estate cash flow example is not the ONLY model out there…

But if you want to replace your income (5 -10k is the popular range), you’ll need AT LEAST 10 of these bad boys.

Not impossible..

But there’s some work to do – wouldn’t you agree?

This is where I see a lot of real estate investors get messed up.

Or, they just stand still because they’re looking for a property or two that’s going to replace that 5k.

It ALL depends on what you want in your life.

And by that, I mean the added stuff that comes with owning properties, managing tenants and/or teams.

Having constant real estate cash flow to replace your income takes some work.

And you REALLY have to look at how your current life is before you go out and waste your time in workshops that SOUND awesome, but you’ll never do it anyway.

Here’s what I mean:

I LOVE the fact that I can buy a small apartment building and replace my 5k income in one fell swoop.

But I’m UNWILLING to do all the work, education and put in the time to buy one.

PLUS, I’ve done enough preliminary research to “understand” that I don’t want to get into that market.

Here’s a big reason why:

I can ONLY sell that apartment to another investor.

AND, the market better be good when I do.

That’s just my personal opinion. You don’t have to agree.

The important part of this is that I know spending my time learning about apartment building investing is a waste of MY time.

Why I’m Showing You This Real Estate Cash Flow Example

Because I like simple real estate.

Single family – one family – is easily liquidated and because I’m buying starter homes, it’s easily liquidated in basically any market.

It doesn’t give me the BEST real estate cash flow at the beginning, but as you can see, after a few years, it’s pretty dang good.

I won’t get into a debate about what’s better or worse – because it really doesn’t matter.

What matters is how it’s better or worse for YOU.

You can do it – but you need to get your ass in gear.

Why?

Because whatever you choose to buy to help you replace that income, needs CASH.

And without cash to inject into your business, you’re done.

That means you either have the cash to buy all the properties you need – or you don’t.

For most of us – we don’t.

And THAT’S the reason going out to find JV investors that align with your investment model, your risk tolerance and so forth is so important.

Hope this helped…

Let me know below – and we’ll get a conversation going about it.