Today I want to show you how to buy investment property…without losing $105,000 in equity.

Here's How

Let’s say two people have a $50k line of credit.

The first dude, the average Joe, decides he “deserves” a new car. And since he only needs to pay the interest on the 50k loan, runs out to buy one.

Spoiler alert – this average Joe will be $105,000 OUT by the end of 5 years.

Because after the other dude buys a property with that same 50k, there’s a difference of $105,000 in net worth after five years.

Don’t believe me?

Read on.

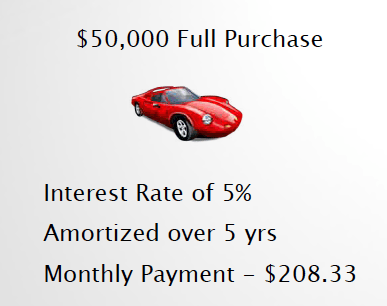

Buying a New Car with a Home Equity Line of Credit

Now like I mentioned, the first dude takes his $50k and buys a new car.

The interest rate on the line of credit is 5%. (it’ll be the same for the property guy too)

To carry that car over 5 years, he only needs to pay the interest rate on the loan.

That is $208.33 per month.

So he’s NOT paying down any of the debt.That means our friend has paid $12,500 in interest only payments, so he can have a shiny new car.

Not bad. The bank has financed it all.

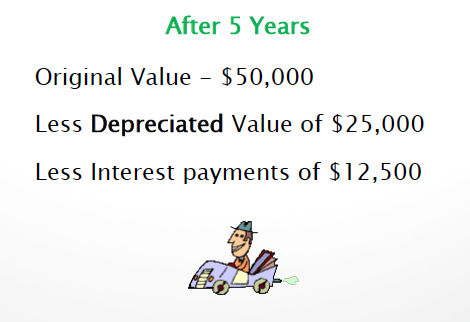

But we both know what happens to the value of cars.

We are now five years in the future. The car has depreciated in value by $25,000. (I’m making all this stuff up for easy math)

When we add in the interest payments to the depreciated value of the car, our friend is now $37,500 in debt.

That’s if he SOLD the car.

You with me?

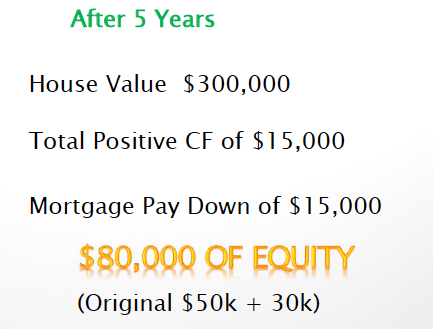

How to buy investment property with that same $50k line of credit…

With that same 50k, you can buy a property worth $250k.

The property has $250 positive cash flow per month.

Along the way, we’re also paying down the mortgage by $250 per month.

AND of course, we need to pay that line of credit expense of $208.33 as well.

What do you think happens after 5 years now?

Well, let’s say the property is now worth $300k for easy math. (It happens :-))

Now you’ve immediately increased your equity by $50k.

Sweet.

But we’re not done yet.

That peasly little $250/m cash flow amounts to a total of $15,000 over 5 years!

BOOM baby!

PLUS, we’ve paid the mortgage down by another $15,000…remember that $250/m pay down thingy?

WICKED - Add on another $15,000 of equity.

Let’s add those up shall we?

50 + 15 + 15 = 80.

That’s EIGHTY THOUSAND DOLLARS you’ve made in 5 years with the original 50K.

Our buddy? He’s in DEBT by almost 40K and STILL owes the original 50k.

Now, I didn’t include the $12,500 interest payments we had to ALSO pay over those 5 years in our investment property example.

Simply because those payments are really a tax deduction.

So you’re “kinda” getting that money back (or applying it against your income-I’m not an accountant, so make sure you ask a professional how to structure this)

But just for shits and giggle, even if we DID subtract that $12,500, you would still be left with $67,500 of EQUITY built on top of the original $50k just because you decided to buy investment property instead of a car!!!

THAT’S how to buy investment property with a line of credit!

Here’s the Bonus…

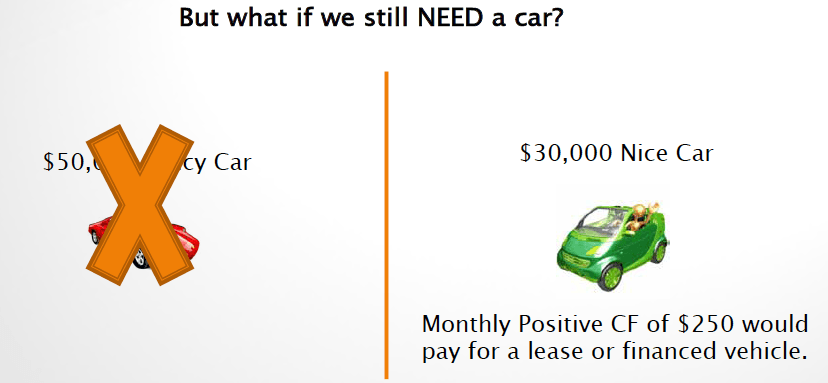

What if you really DO need a new car?

Well, I would argue you DO NOT need a $50,00 car.

In fact, you can easily finance a pretty DECENT new car for $30k.

And you can do that with the monthly cash flow of $250!

BOOM AGAIN BABY!

Now. Are you ready for this?

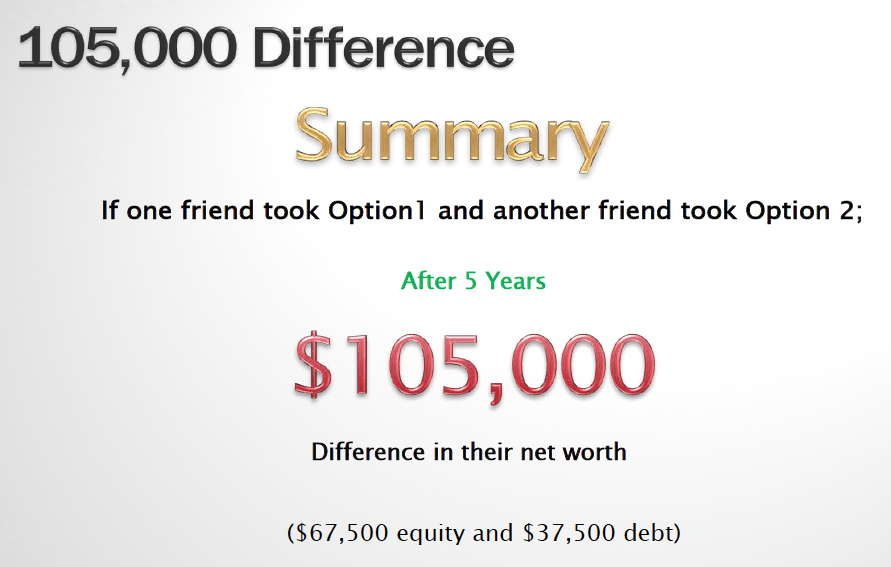

After 5 years, if one person took option 1 and bought a car and another friend took option 2…

There is a difference of $105,000 in their equity over 5 years!

Can you see that?

WOW

37,500 debt + 67,500 equity = $105,000 difference in net worth.

In other words, one dude OWES and one OWNS at the end of 5 years.

Which one do you want to be?

Like this? Let me know in the comments below - share it with your friends and family if you want them to understand why real estate is so powerful.

I've used this SAME slide deck for YEARS to really drive the message home when I'm talking to potential JV investors who continue to give me reasons why they "can't" or "won't" invest in real estate.

(props to my friend Wade Graham where I stole this original idea from)

согласование выполненной перепланировки квартиры [url=http://www.soglasowanie-pereplanirovki-kvartiry.ru]согласование выполненной перепланировки квартиры[/url] .

оформить проект перепланировки квартиры [url=https://proekt-pereplanirovki-kvartiry.ru/]https://proekt-pereplanirovki-kvartiry.ru/[/url] .