I want to show you a fast and simple real estate cash flow formula that will reveal your personal FREEDOM number.

That freedom number I’m talking about is EXTREMELY important to know.

Because it’s a number that will tell you how much you need to get out of your job and continue living without worrying.

Here’s a quick video walk through for the real estate cash flow formula:

How This Real Estate Cash Flow Formula Works

There are just 3 simple calculations you need to do.

Step1:

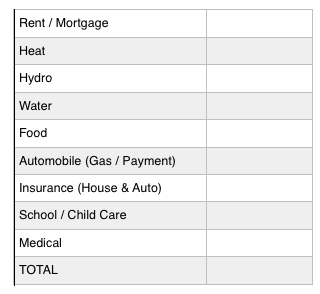

The first one is your basic monthly expenses – something like this:

The focus is on BASIC monthly expenses – which means your monthly living expenses without all the fancy restaurants, take out, entertainment, etc.

I’m not saying to cut all that out completely. However, just for this exercise I want to ground you at this point.

Because we need to know the expenses that you need to SURVIVE so you don’t end up living in a box under a freeway or somewhere.

For now, this doesn’t have to be an exact number – because you probably know how much things cost.

When you get that number, multiply it by 12 – and that’s your “survival” expenses for the year.

What About Taxes?

The next step in our real estate cash flow formula is to take that monthly expense number, and ADD 50% to it.

Because we have to pay taxes, right? And yea, I know most of us are not in a 50% tax bracket, but let’s just make it easy and add that to our calculation, okay?

Step 2:

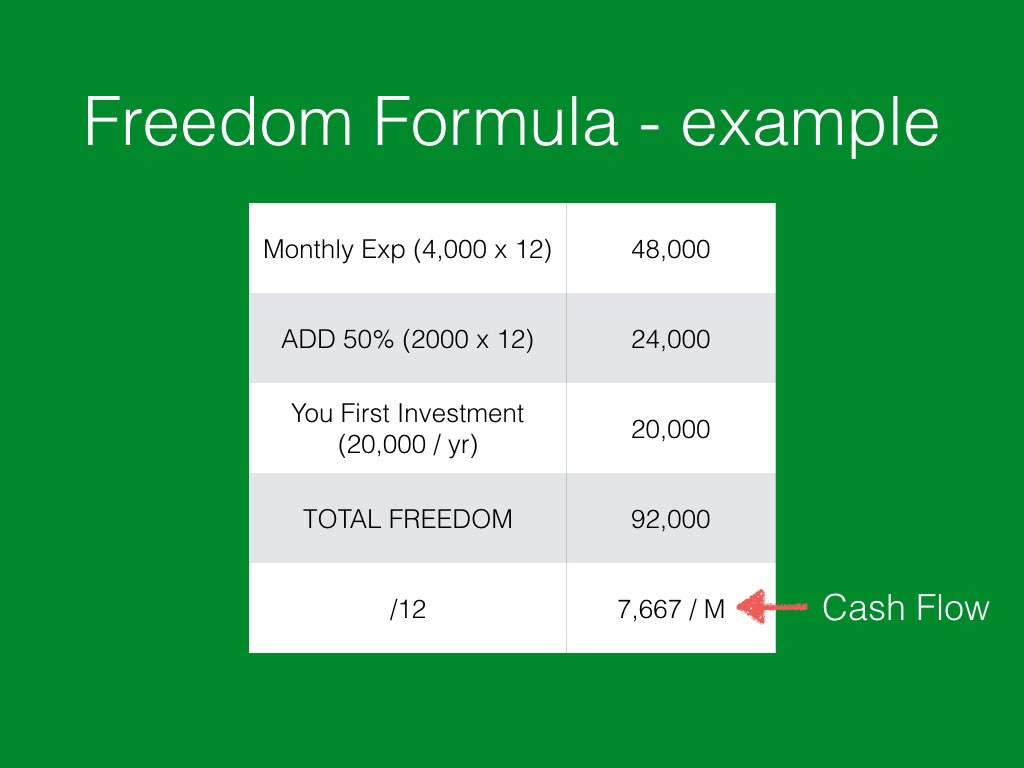

So let’s say that your monthly expense number was $4000 (which is $48,000 per year)

You don’t need to make $4000 per month, you actually need to make more than that because of the taxes.

That means if you want to really be free, add $2000 (in this example) to your monthly expenses.

Now, do the same thing you did for step 1, and multiply by 12 – in this case, $24,000.

Finishing Up The Real Estate Cash Flow Number

Finally, we’ll add a “Pay Me First” number to our real estate cash flow formula.

This is for investments. And for most people outside of real estate, that would mean putting money into mutual funds or stocks or some other investment.

This number can be anything you want. It’s there to help you plan for the future – again, because most people live only surviving to get through today and don’t think about tomorrow.

For this example, I’m making it easy and putting $20k per year aside.

Step 3:

Because we’re in real estate, we’ll probably want to budget a bit more to buy a property per year at least…but this is going to make my math easier for me 🙂

Now that we have all our yearly numbers, let’s add them together:

In my example, $48k + $24k + 20k = $92k

$92,000 is my FREEDOM NUMBER.

In order to be free, and pay my taxes, while still making some investments, I need to bring in $92k.

The last step, to get your cash flow number, is to divide your final freedom number by 12.

94/12 = 7,667 per month in cash flow.

Basically, this person needs $8,000 in cash flow to be totally free.

Of course, this NOT about the rich with diamond “lifestyle” we all want. But it IS the real FREE number.

Because anything over and above this number is all “gold” as they say!!

There you go – an important real estate cash flow formula to know, don’t you agree?

Don’t forget to watch the video example if you need a bit more clarification – it’s taken from my Accelerator Action Coaching group videos…but you’ll get it!